Introducing the NEWPosition Type View

Now Manage Your Options with Greater Clarity

Effective position review is essential for option traders.

That's why we've developed the new Position Type view on BMO InvestorLine – empowering you with an intuitive, streamlined view of your option holdings.

See the new Position Type view in action:

With this new view, you get:

-

Intuitive Strategy Visualization

Effortlessly identify your option strategies at a glance, with positions grouped by type (Long Calls & Puts, Covered Calls & Puts, Long positions, Short Sells, Spreads & Combos and Naked positions).

-

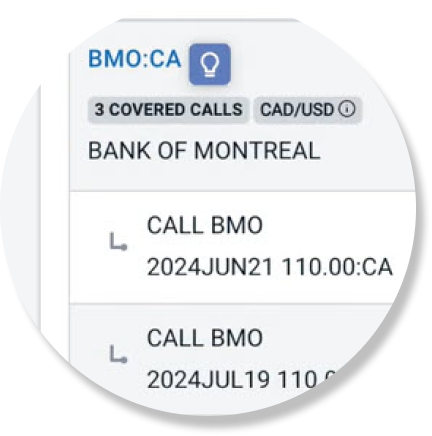

Visually Linked Positions

Gain clarity on complex holdings with securities connected, visually demonstrating relationships within your portfolio.

-

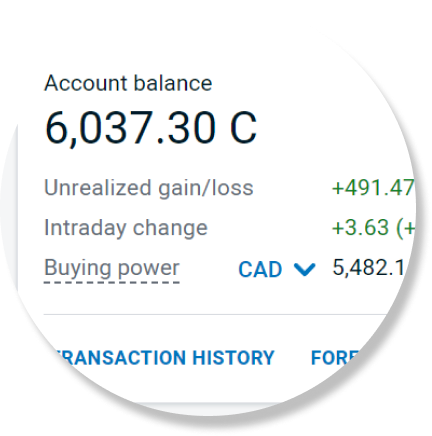

Intraday Margin Updates

Make better informed decisions by seeing how your option holdings influence margin calculations, with updates every five minutes.

-

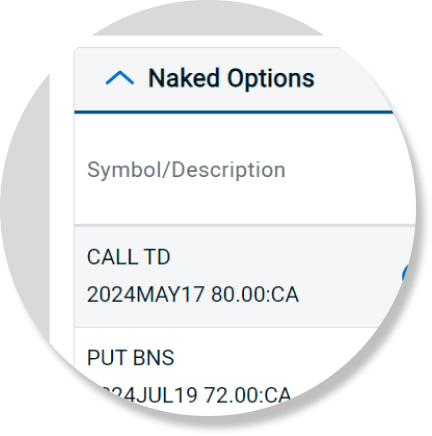

Margin Visibility

Easily view margin requirements for all your positions including Spreads & Combos and Naked options.

Make Informed Options Trading Decisions with Confidence.

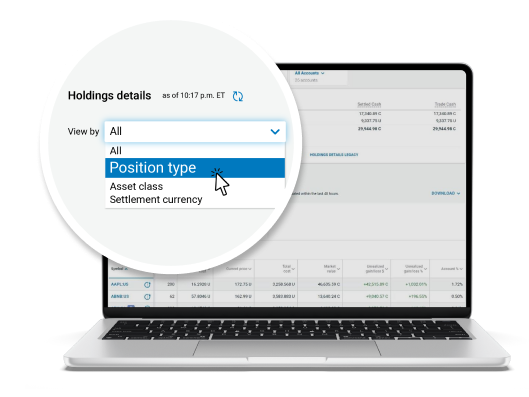

When signed in on desktop/laptop, go to the Holdings Detail screen and select Position Type in the View by dropdown menu.

Frequently Asked Questions

To access this screen, just go to the Holdings Detail screen; click on the View by dropdown menu, then select Position Type.

No, the classification may change as conditions change in your margin account. For example, if you buy 1,000 shares of stock XYZ without any other securities in the account, then XYZ would initially be placed in the Long Positions section. If you then sold 10 short calls against it, then the 1,000 shares of XYZ and the short calls would be placed in the Covered Calls & Puts section.

This categorization update would occur within five minutes of the short call being filled. The recalculation occurs at the same time the buying power is updated.

There are two rules for classifying options and linking them together in a margin account:

- 1) The system follows the rules for which securities can be linked together. For example, a short call cannot expire after a long call in a spread; therefore, these would not be paired together.

- 2) The system aims to pick the combination that reduces the overall margin requirement of the portfolio, providing you with the highest buying power possible.

No, our system doesn’t support changes in classification or pairing of securities.

The system only makes this change to minimize the margin requirement for your account. However, you are still free to close out the position in any manner you would like.

The new Position Type view updates every five minutes, so a trade filled within the last five minutes will not be reflected there. However, a banner at the top of Holding Details will inform you of the fill, and the Position Type view will be updated within five minutes. The other holdings screen will be updated in real time for these fills.